BOI Filing - An Overview

Under the Corporate Transparency Act (CTA), FinCEN requires most small businesses to report their Beneficial Ownership Information (BOI) starting on January 1, 2024. This law was passed to improve financial transparency and eliminate money laundering and other similar crimes.

Whom Do We Serve?

Businesses

Law Firms

Accountants

Professional service firms

TaxBandits Streamlines Your BOI Filing

with Numerous Features!

Easy and Secure Filing

With TaxBandits, you can file your BOI report seamlessly. Our user-friendly software ensures the utmost safety and security of

your data.

Streamline reporting with

Step-by-step Instructions

Our user-friendly application offers comprehensive guidance throughout the reporting process with clear and helpful instructions.

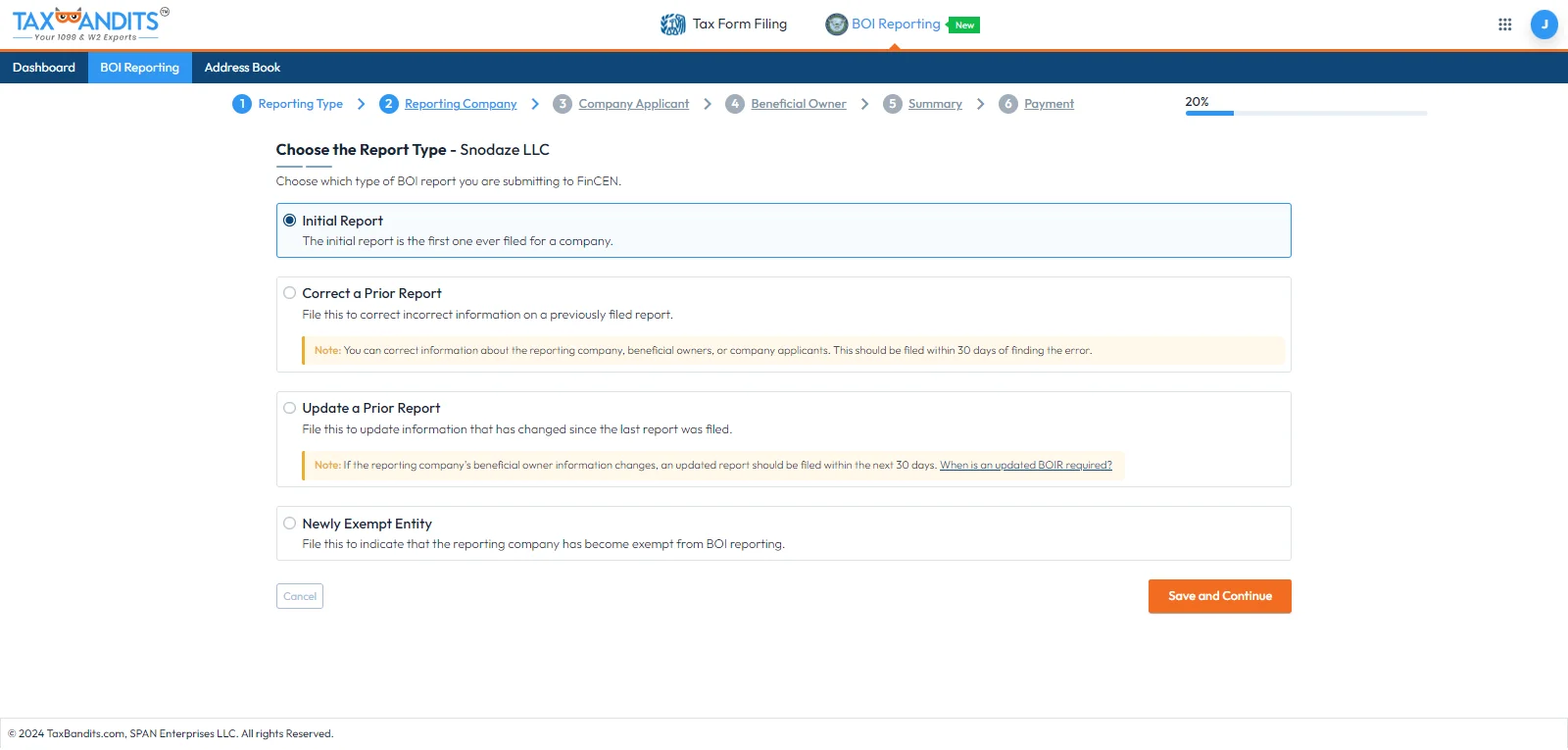

Comprehensive BOI filing solution

From filing your initial BOI report to corrections, updates, or new exempt entity filings, TaxBandits has everything you need. Manage all your BOI filing at one place.

Effortless Data Reuse with TaxBandits

TaxBandits eliminates the need to enter the same data twice. You can seamlessly select your saved information from the address book and use it without any hassle. No more repetitive typing, just quick and seamless filling.

Invite beneficial owner via Secure link

With TaxBandits, you can invite beneficial owners to complete their personal information through a secure link. This way, they can provide details at their own pace, ensuring comfort

and privacy.

Save and Continue at Your Own Pace

TaxBandits allows you to save the progress of your BOI report at any time and continue from where you left off. It's flexible and designed to fit into your schedule.

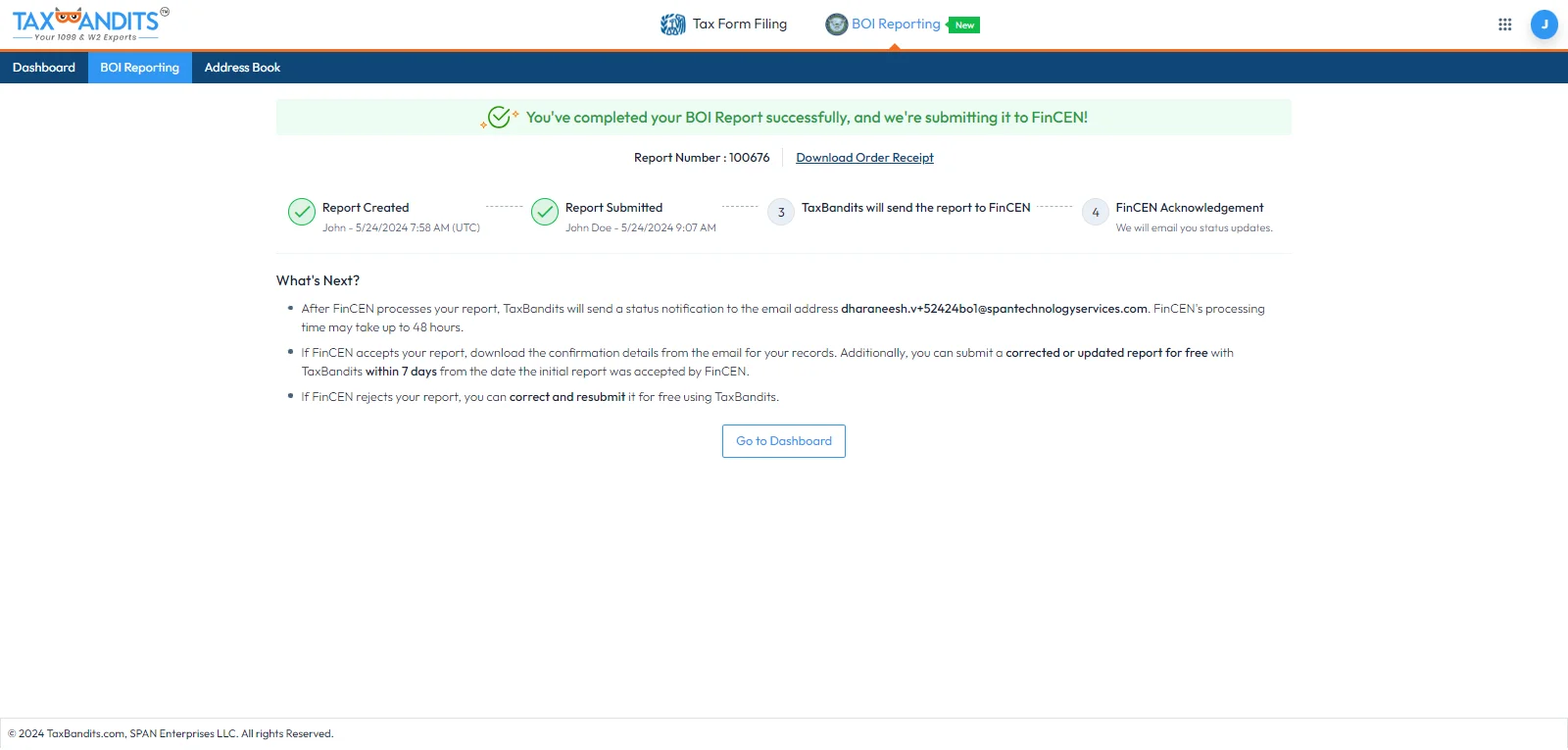

Instant status update

Once you've submitted your BOI Report, TaxBandits will update you on its status, ensuring you're always

up-to-date.

A week to file Free Correction

We know that mistakes can happen. That's why with TaxBandits. you can make corrections to your initial BOI report within a week at no extra cost. Just a simple, foolproof way to ensure accuracy.

Free Resubmission for Rejected BOI Reports

No need to worry over FinCEN rejections! With TaxBandits, you can correct and resubmit your BOI report as many times as needed, all without incurring any additional costs. Keep refining until it's perfect!

PRO Features - Exclusive for Tax Professionals!

Staff Management

- Invite your team to manage your BOI filings

- Track your team members’ filing activities

- You can add unlimited members, providing a unique login for each

- Delegate filing responsibilities to team members

Client Management

- Invite your clients to submit necessary data for BOI filing

- The user-friendly dashboard shows all of your clients' filings at a glance

- The client portal allows you to maintain seamless communication with your clients

- Easily track and manage your clients’ BOI filings from one secure location

Affordable & Efficient Filing

- TaxBandits offers volume-based pricing - The more you file, the more you save

- Import all your clients' BOI report information at once using our Excel template, and save time!

- Gain key insights into your BOI filings from the various reports offered by TaxBandits.

BOI Filing Deadlines

For businesses created or registered before

January 1, 2024

The deadline for the initial BOI report filing is

January 1, 2025.

For businesses created or registered on or after

January 1, 2024

The deadline to file the initial BOI report is within 90 days of

their company registration date.

Note: Late filings can result in fines of $500 per day, up to $10,000

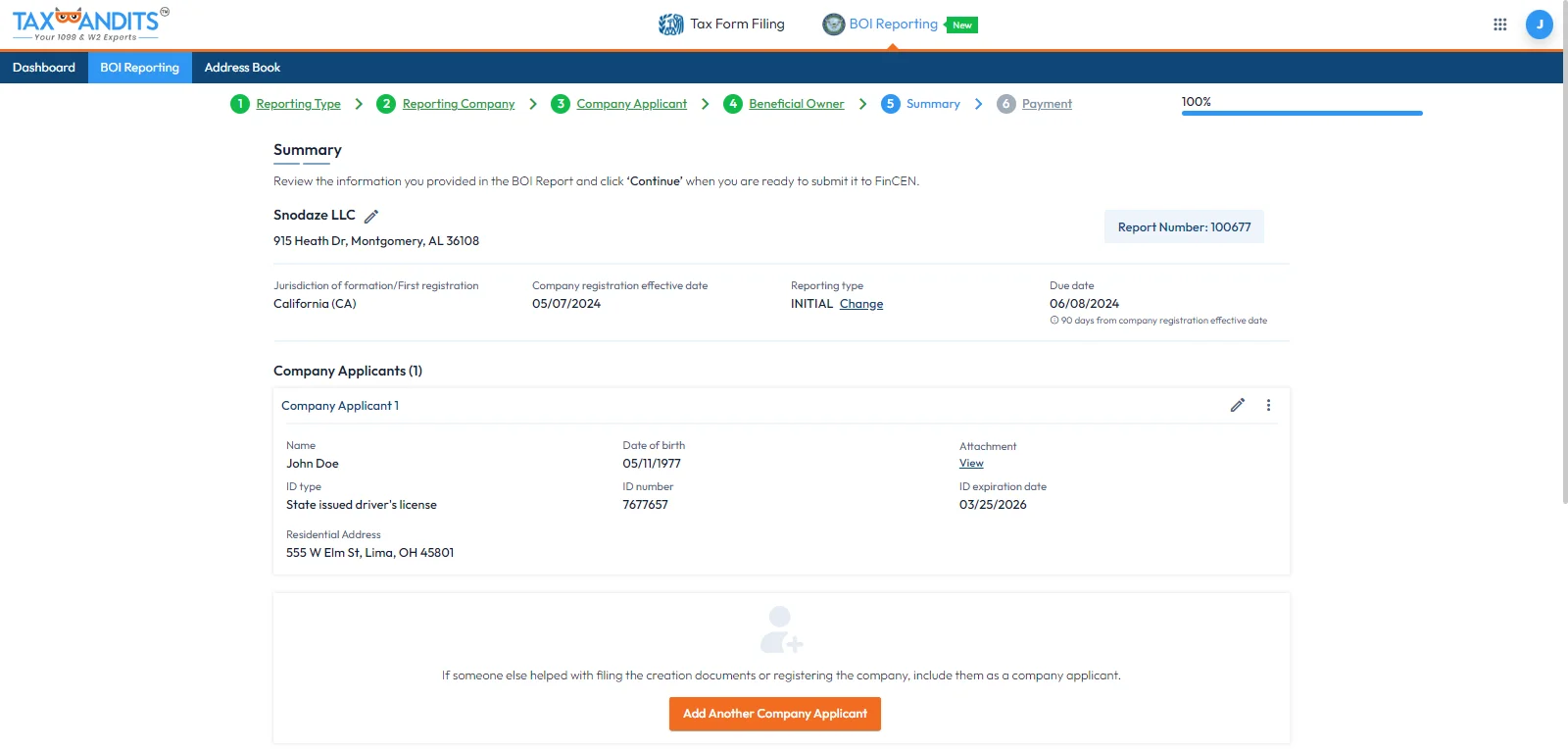

How to File BOI Report Online?

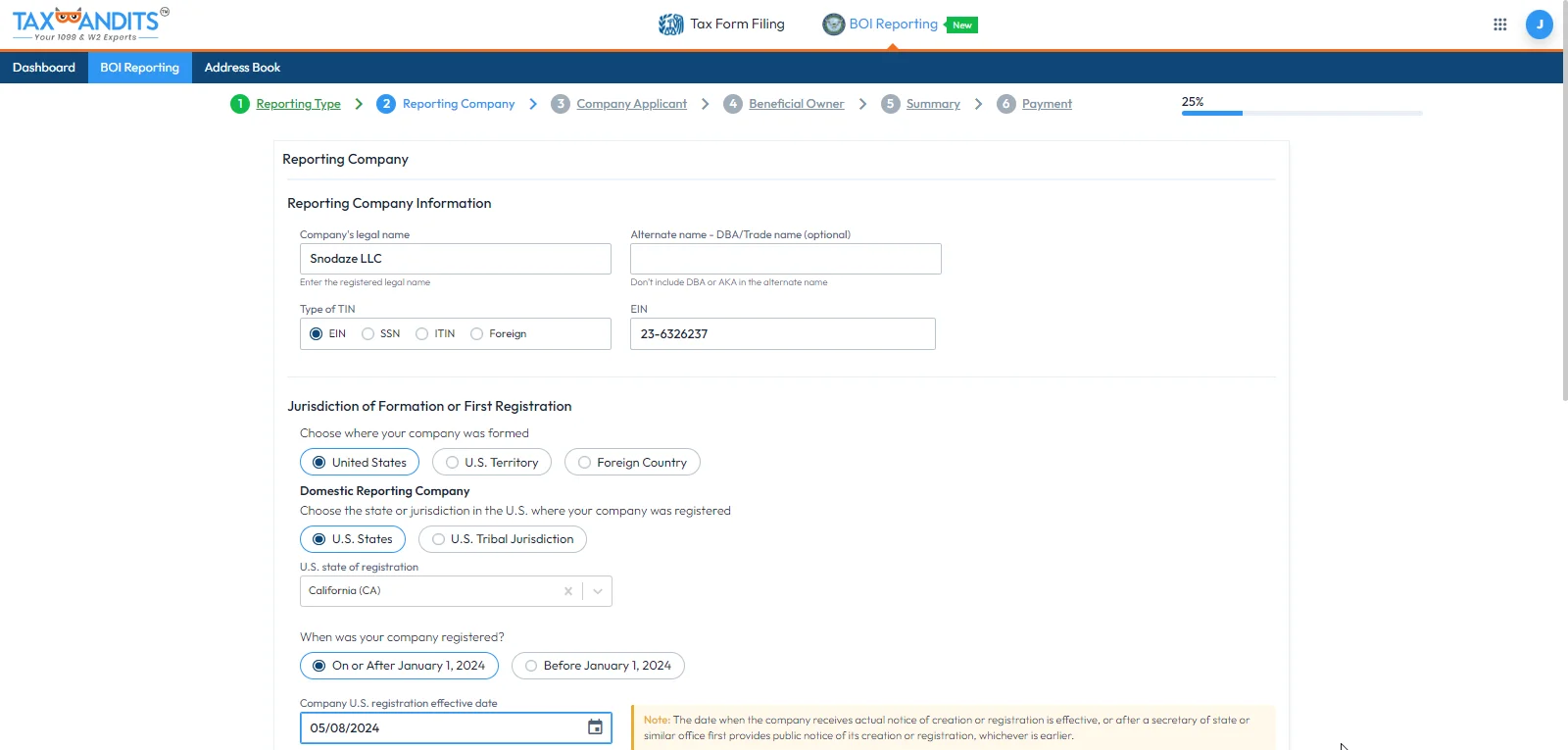

- 1 Enter the Required Details of the Reporting Company

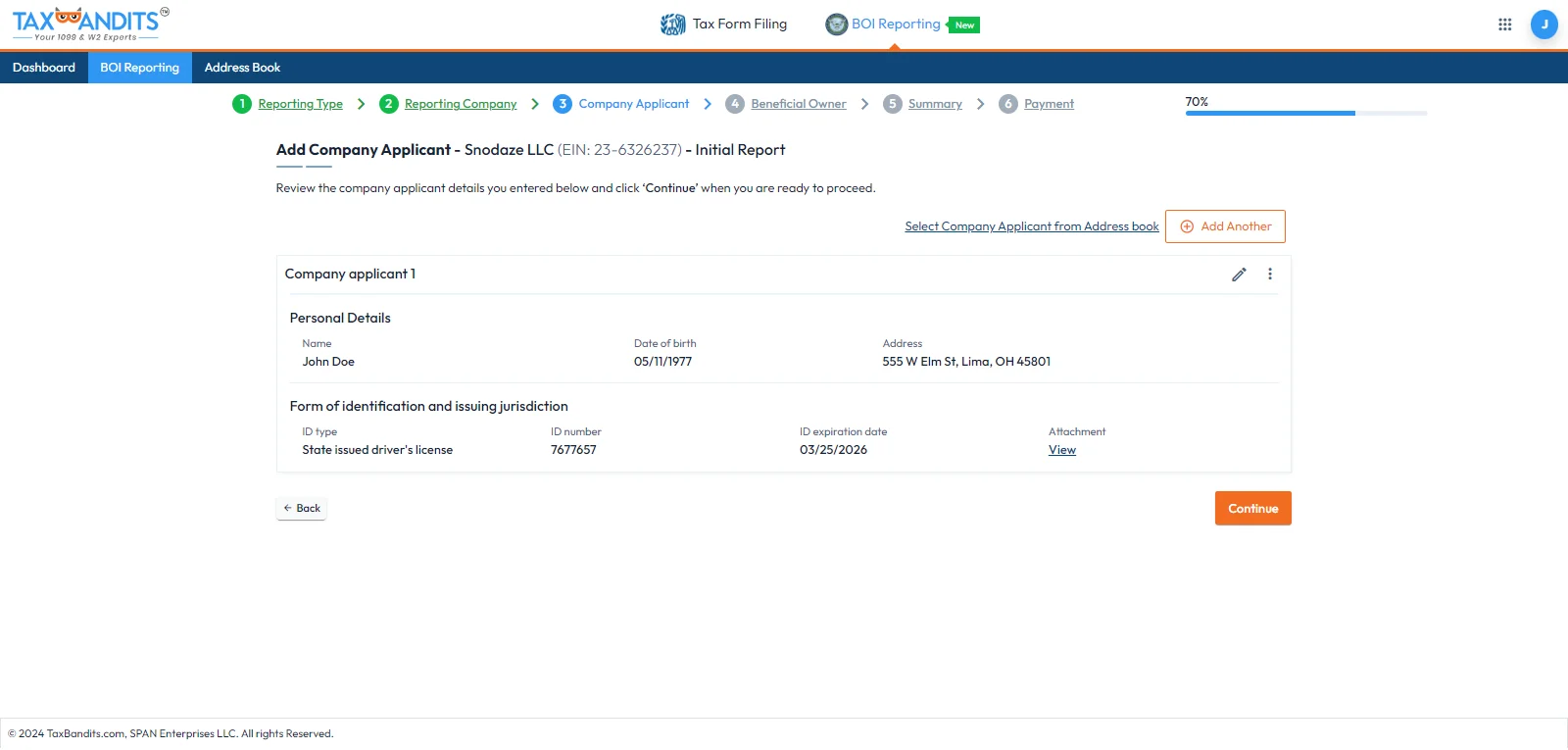

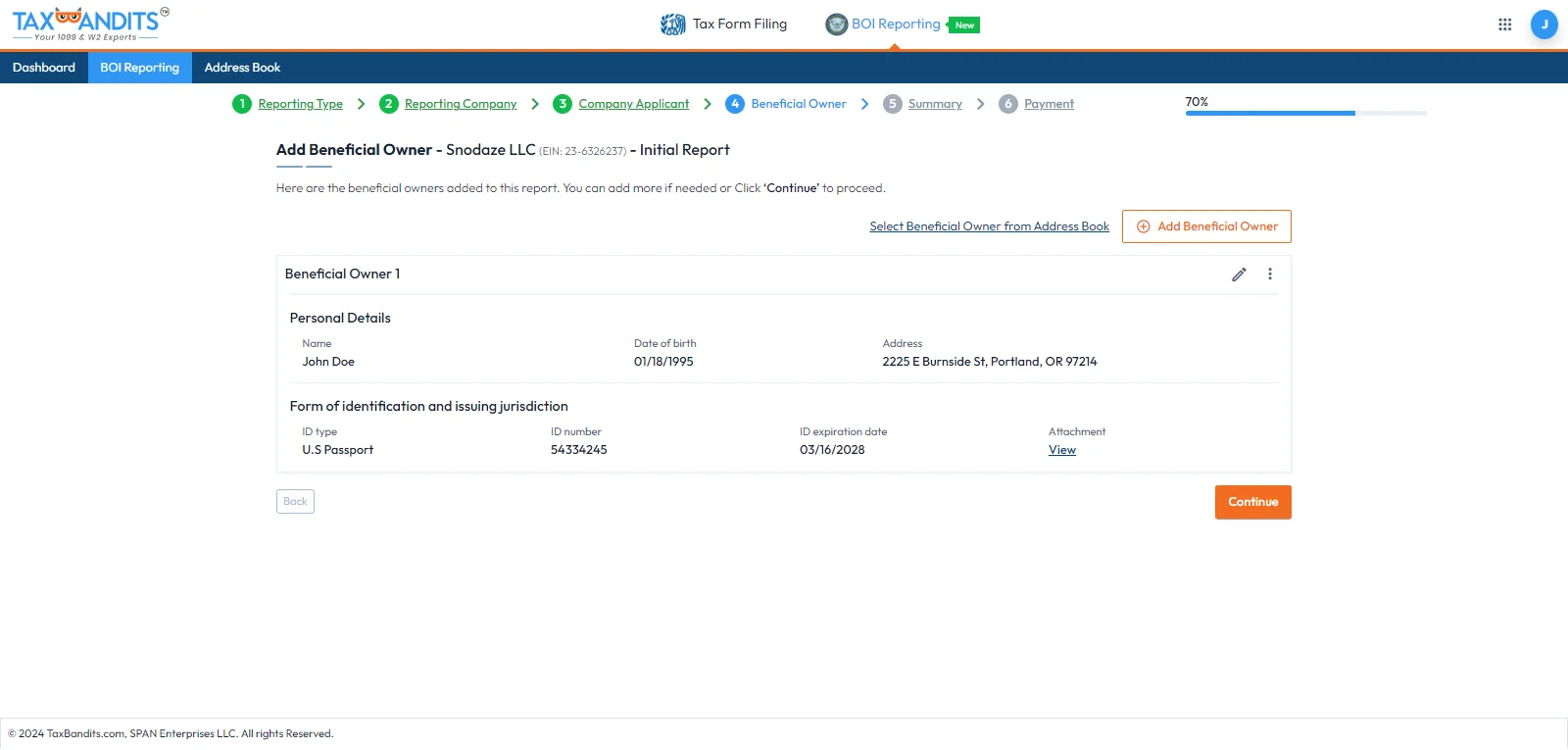

- 2Add Beneficial Owners & Company Applicant Information

- 3Review & Submit BOI Report to FinCEN

Cost to File BOI Report Online with TaxBandits

One Time BOI Reporting

$49

- Flat Fee Per Single Filing

- Free Corrections within one week of filing

Annually Per Entity

$79

- Unlimited Filings per year

-

Unlimited corrections

per year

Lifetime Per Entity

$199

- Lifetime Unlimited Corrections

- Lifetime Unlimited Updates

Annually (Unlimited Entity)

- Unlimited BOI Filings (Initial, Correction, updates)

- Unlimited Companies

Data Security is our Highest Priority!

As a SOC-2 certified provider, TaxBandits safeguards your sensitive information, including PII data like SSNs, using robust security measures.

Frequently Asked Questions about BOI Filings

Generally, the following companies are required to complete BOI reporting:

- Domestic Entities - Any domestic business that operates under U.S. tax laws. This includes corporations, LLCs, limited partnerships, and limited liability partnerships (LLPs).

- Foreign Entities - Any entities that are established outside the United States and conduct business in the U.S.

According to FinCEN, any individual or a group of individuals who has substantial control over the reported company or has at least 25% of the ownership interests of the reported company directly or indirectly. Click here to know more about the beneficial owner(s) of a company.

A company applicant can be an individual who directly files the document that registers the company or the individual who is primarily responsible for the filing (when more than one individual). Click here to know more about the company applicant for a company.

There are 23 types of entities that are exempt from BOI reporting. Here are they,

| Exemption No. | Exemption Short Title |

|---|---|

|

1 |

Securities reporting issuer |

|

2 |

Governmental authority |

|

3 |

Bank |

|

4 |

Credit union |

|

5 |

Depository institution holding company |

|

6 |

Money services business |

|

7 |

Broker or dealer in securities |

|

8 |

Securities exchange or clearing agency |

|

9 |

Other Exchange Act registered entity |

|

10 |

Investment company or investment adviser |

|

11 |

Venture capital fund adviser |

|

12 |

Insurance company |

|

13 |

State-licensed insurance producer |

|

14 |

Commodity Exchange Act registered entity |

|

15 |

Accounting firm |

|

16 |

Public utility |

|

17 |

Financial market utility |

|

18 |

Pooled investment vehicle |

|

19 |

Tax-exempt entity |

|

20 |

Entity assisting a tax-exempt entity |

|

21 |

Large operating company |

|

22 |

Subsidiary of certain exempt entities |

|

23 |

Inactive entity |

Primarily, you’ll need the following information to complete your BOI report

- Reporting company details such as Name, EIN, Address, etc.

- Type of the report (Initial, Update, Correct or Newly Exempt Entity)

- Information about the Beneficial Owners (Name, Date of Birth, Address and Identity Proof)

- Details of the Company Applicant(s) (Name, Date of Birth, Address and Identity Proof)

Visit https://www.taxbandits.com/boi-instructions/ to learn more about BOI filing Instructions.

According to the FinCEN rule specified in the Corporate Transparency Act, anyone who fails to comply with the BOI reporting requirements will be subjected to civil penalties of up to $500/day. Furthermore, there can be criminal penalties of up to two years imprisonment and a fine amount of up to $10,000.

Helpful Resources to File BOI Report Online

BOI Reporting Requirements

FinCEN BOI Report Filing Instructions

BOI Report For LLC

Related Blog for Filing BOI